Don’t sabotage the potential value of your ERP modernization with poor configuration leading to inaccurate data.

The value of Enterprise Resource Planning (ERP) software in supply chain management is undeniable. Integrating ERP modules such as finance and accounting, engineering, production, inventory, purchasing, and others improves the flow of information between business units, making teams more collaborative and efficient.

Yet research produced by Foundry for Hitachi Digital Services and Oracle shows that most companies experienced problems around the accuracy, availability, and even trustworthiness of their financial data when using ERPs.

The survey of 100 financial decision-makers in the USA and UK found inaccurate financial data caused problems for 94% of companies, with one in five saying they had trouble tracking true project costs and revenue.

Hitachi Digital Services found some of the problems stem from where companies misconfigure their ERP when trying to do too many things at once – and do them incorrectly. For example, businesses may add extra management information (MI) reporting structures into their chart of accounts. These extra steps slow down business processes and systems. Instead, Hitachi Hitachi Digital Services way of doing things is to streamline ERP systems for financial journal accuracy and speed of regulatory close, assisting them with new technology cloud modules to meet their other business value-add requirements such as Enterprise Performance Management (EPM).

We implement ERP systems by streamlining processes and data entry automation/integration so users can access accurate financial and operational data and supply chain management activities.

Having these kind of accurate, actionable insights to hand is invaluable in a modern business world, but relies on timely and accurate data which should be easy to enter and maintain in a well-configured system.

Inaccurate financial data caused problems for 94% of companies

Proper configuration of an enterprise ERP system is crucial to meet financial and reporting accuracy goals. Before implementing ERP software, a company must start by finding an ERP platform that best matches their business processes and a provider that understands the needs of each department. Failure to do so can result in thousands of

wasted dollars on ERP add-ons and additional customizations.

Where businesses have already found themselves in this dilemma, Hitachi Digital Services and Oracle have been able to help them reconfigure to simplify these problems and help alleviate issues.

For example, by effectively aligning ERP structures and utilizing Projects modules, they have helped numerous companies in the Oil and Gas Services sector and Engineering, Procurement, and Construction (EPC) industries gain a much better understanding of profitability at a project, asset, contracts, and customer level – straight from the core

ERP platform.

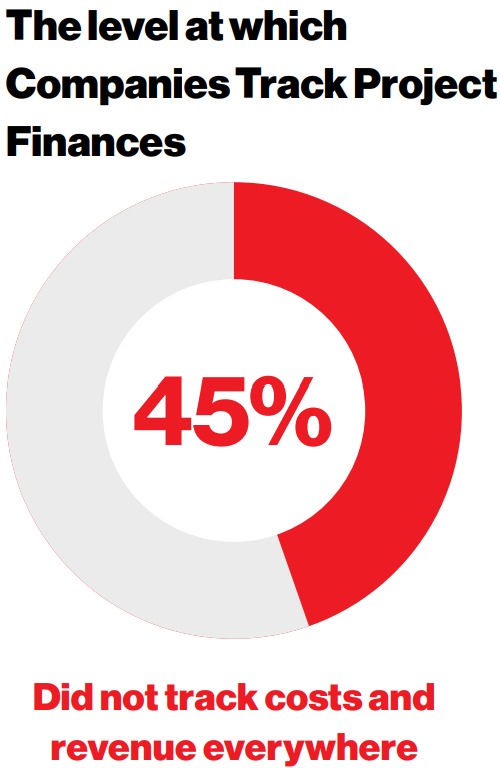

Around half of companies responding to the survey said they did not track project finances everywhere, more than half had to manually update project-level financial data often or very often, and two-thirds said having to do so cost the organization the equivalent working hours of between 10 and 11 full-time employees a month.

The survey’s findings also pointed to a disparity in what respondents felt was the quality and reliability of the data available for them to work with, depending on the type of ERP each firm was using and the company’s size.

For businesses to get the best from all available data, they need to take steps to ensure it is being recorded accurately at all levels, and then harnessed in a way that is both understandable and useful for day-today operations, compliance, and strategic planning.

This may involve utilizing other functional modules to help such businesses with compliance, improved reporting, and actionable insights into their data. Such modules can help compliment ERP with EPM solutions.

By providing a better structure within ERP, Hitachi Vantara has helped its customers to centralize reporting onto their Oracle ERP platform and save hundreds of thousands of dollars on third-party reporting tools. It is also common to see financial period close cycles reduced to as little as five days or lower when cloud ERP is implemented and used correctly.

An ERP can solve a variety of business challenges such as too many manual processes or repetitive tasks, poor communication and disconnected systems, lack of financial and operations data visibility, and lack of agility and access.

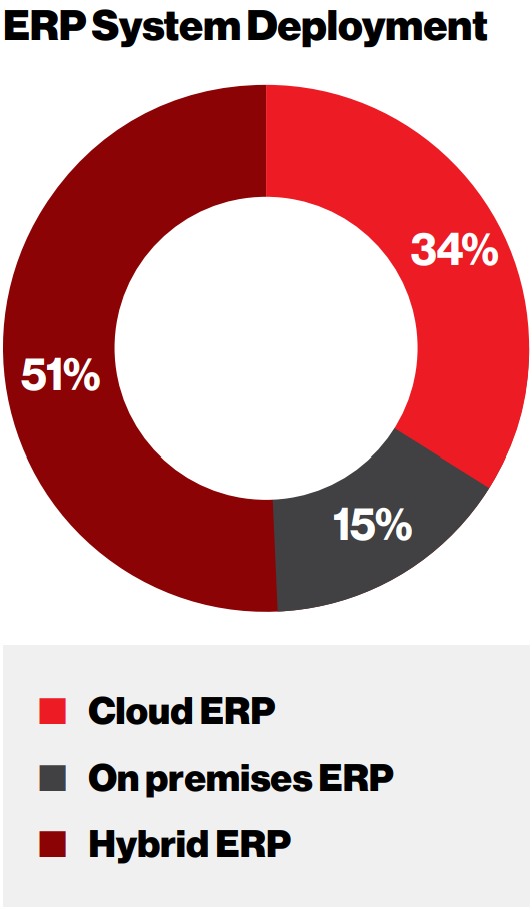

So, what does the ERP picture look like right now? All the companies that responded to the survey used some form of third-party ERP software. These systems were broken down into three types.

About one third used cloud, 15% used on premises, and about half adopted a hybrid approach. About one in five said they used an ERPin-a-box, effectively a pre-designed “off the shelf” solution. More than three quarters used a large scale or intermediate ERP.

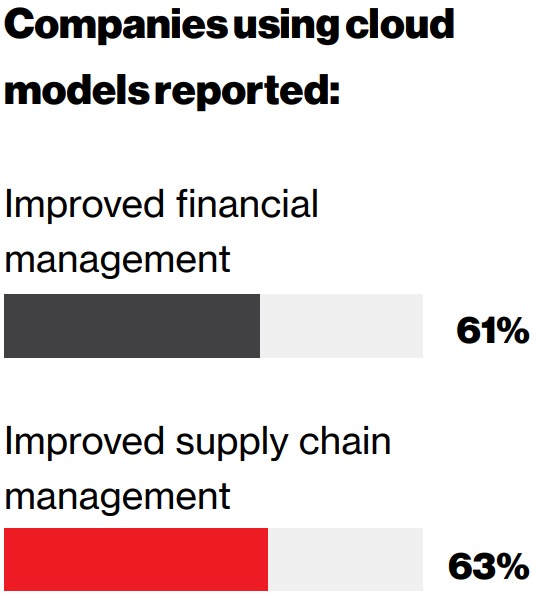

Those that used Cloud delivery models cited better management and forecasting as key capabilities and reported improved financial management (61%) and supply chain management (63%). They also found its ability to integrate emerging technology and analytics solutions to be a competitive advantage.

When implemented correctly, ERPs can provide a solid foundation to help manage data and simplifying reporting of key insights. But when implemented poorly, they can cause frustration and inefficiency.

Hitachi Hitachi Digital Services has helped its distribution clients gain near real time visibility of data across the supply chain, as well as giving them a clear understanding of stock positions across their network. This enabled better decision-making, and ERP enabled forecasting and scenario planning which helped them reduce inventory by 7%, improve on time in full (OTIF) by 6%, and improve stock availability by 9%.

When implemented correctly, ERPs can provide a solid foundation to help manage data and simplify the reporting of key insights. But when implemented poorly, they can cause frustration and inefficiency.

The way data is being utilized by companies has changed in recent years. Previously, many companies had collected it only in order to maintain compliance, but increasingly they see it as a priceless resource that then enables longer term strategic planning. The problem is that such data which may previously have been “good enough” to maintain compliance, is often not good enough or sufficiently granular or in time for effective and informed decision-making.

This is something that companies are increasingly all too aware of. The survey found that one of the biggest concerns for companies was “lost opportunities,” which indicates a strong desire to better harness their financial and supply chain data. Firms also placed improved decisionmaking (33%) and increasing the speed and accuracy of estimating and bidding (29%) as top priorities for planned IT investment objectives for the next 12 months.

How they go about addressing these concerns though can be problematic. Companies do things such as attempting to capture further management information or other reporting data in further broken down subledgers or additional chart of accounts segments. However, this approach slows down the period open and close processes and any roll up calculations – as well as being inflexible to any business reorganizations required in the structure of the reporting hierarchy

Few companies have tried to achieve similar reporting through “off system” work – either informally in spreadsheets, or sometimes through loosely connected third-party solutions.

James Easy, Vice President of the ERP practice at Hitachi Digital Services, said: “Whilst such dashboards look great, the loose connection with the real base financial data brings its own issues – such as out-of-date data, data without a lineage of where it really comes from, or in the very worst cases – just wrong information that looks professionally correct when it’s not. When we asked one customer ‘How many products do you sell?’ then we got three radically different answers from different managers due to these problems.”

One of the biggest concerns for companies was “lost opportunities,” which indicates a strong desire to better harness their financial and supply chain data.

Recording accurate financial data is crucial for day-to-day operations and longer-term planning. Plus, it also helps build a strong financial position for external stakeholders including potential investors, financial institutions, and regulatory bodies. The survey found that 62% felt financial data was “very important” while 29% regarded it as “essential”.

Having inaccurate data can cause huge problems, including cash flow issues, poor decision-making, wasted resources, and lost time.

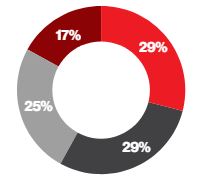

Hitachi Digital Services and Oracle’s survey found poor data had a range of impacts on companies, including budget overruns (29%), lower overall productivity (29%), increased labor costs (25%), and poor employee morale (17%).

They have seen where such businesses are held back from trying to address such issues because “the data is probably just wrong” which devalues any analysis of such problems, so nothing gets done.

One of the biggest problems around data accuracy is the silo effect that comes from having multiple reporting tools being used by different departments. This can result in basic misunderstandings and even disagreements between different parts of the company about what are the correct figures to input into the ERP in the first place.

It is, therefore, important to implement ERP with the help of the right experts who can configure ERP in such a way as to enable companies to leverage the visibility and insights their data can provide.

James added: “By effectively aligning ERP structures and utilizing Projects and Enterprise Performance Management modules, we have helped numerous companies in the Oil and Gas Services and EPC industries gain a much better understanding of profitability at a project, asset, contracts, and customer level – straight from the core ERP platform.”

Just investing in a new ERP and expecting it to fix everything simply will not work – it has to be part of a wider solution that includes the right experience and expertise to help implement it.

felt financial data was “essential” to tracking project profitability.

felt it was “very important.”

ERP is the preeminent software that can help identify true cost and profit margins. However, identifying true costing for a job or project is not easy because of the complex nature of business.

One of the biggest issues causing these problems for companies is that they take a piecemeal approach to what they track. The survey found most organizations tracked costs and revenue at different levels of the project, but about half did not track project finances everywhere.

The survey found one in five organizations had difficulty tracking true project costs and revenues, and that those that must make regular updates have the greatest difficulty. This in turn led to lost time, with more employee time being assigned to making updates.

This problem was exacerbated when ERPs-in-a-box were used, due to the fact the solution was not specifically tailored to the organization’s needs. This meant more data had to be added manually, opening up the prospect of inaccuracy caused by human error. It also increased delays, which had an impact on cost.

Companies with ERP-in-a-box reported heightened accuracy challenges, specifically due to data quality issues and manual processing of data required. This created distrust in the numbers reported. The survey found a higher mistrust of reporting among companies using ERP-in-a-box (55%) compared to large scale ERPs (34%), and intermediate (37%). This mistrust tended to stem from uncertainty about what the single source of truth was for the company’s reporting.

Overcomplicated financial reporting tools (31%), excessive manual data entry/processing (34%), and lack of collaboration and communication among users (30%) were also issues.

A significantly higher proportion of those using ERP-in-a-box also reported regulatory fines (36%), compared to large scale (11%) and intermediate ERPs (14%).

ERP-in-a-box

Large scale ERPs

Intermediate

Intermediate/flexible ERPs were more prone to difficulty in transferring assets across projects and/or legal entities (37%) and scattered project-related data (35%).

Customer data was much less accurate for smaller companies (between 1,000 to 5,000 staff) than for larger companies (5,000 and above). Larger companies found 61% of their customer data was accurate, as opposed to 41% for their smaller counterparts.

Companies respond to the poor availability of data in several ways, many of which can lead to poor, inaccurate information or unnecessarily increased complexity.

Owen Dowden, a Senior Director at Hitachi Digital Services, said: “We see lots of companies struggling to see profitability at the right level of granularity. That’s something they find quite hard to do. We find they start using some of the components in their ERP which are designed for high level financial view. That’s not the right way to do things because they cause other issues, like too much complexity.”

He said another issue some businesses struggle with is that they have what is essentially a “mini industry” of separate business intelligence (BI) reporting processes with different (and disconnected) tools to capture data in a specific area of the business. This not only increases the complexity of their IT systems and data-recording operations but can also cast doubt on what the single source of truth was when it came to company data.

of those using ERP-in-a-box reported regulatory fines compared to large scale (11%) and intermediate

ERPs (14%)

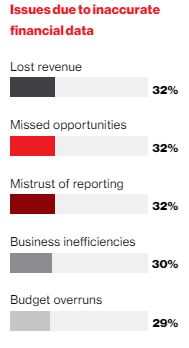

Inaccurate financial data caused a range of problems for the companies that responded to the survey. Chief among them were lost revenue (32%), missed opportunities, (32%), mistrust of reporting (32%), business inefficiencies (30%), and budget overruns (29%).

A total of three in five said lack of visibility negatively impacted decision-making, while a similar number reported data management as their biggest issue.

It is clear that inaccurate financial data had the potential to negatively impact every single aspect of each business responding to the survey, from operational effectiveness and revenue generation to the ability to plan for the future.

Improved decision-making and on time delivery over the next 12 months were priorities for many companies that responded to the survey.

More than a third (34%) were going to upgrade their current ERP with the same vendor. Only 11% planned no changes at all. The survey also found a general trend towards new vendors to improve analytics and usability. This would seem to indicate that companies value ERPs and are not satisfied with retaining systems that are not right for them. Businesses are willing to invest in new solutions if they feel it will bring tangible benefits.

Top of respondents’ list of priorities when it came to ERP investment were improved analytics and reporting (56%) and increased usability (52%).

Accurate financial data maximizes efficiency and protects revenue in an increasingly uncertain world. It also supports longer term planning and enables companies to fulfil statutory obligations.

Companies have placed their trust in ERP software to help shoulder some of the burden, but it cannot do everything. ERP-in-a-box causes problems due to the gaps it leaves because it is a “one size fits all” solution. But all companies are different. Not just in scale and the industries within which they operate, but in what data they record at ground level and what data is defined as the single source of truth.

This research uncovered an understanding of the problems caused by inaccurate financial reporting as well as a desire to migrate to newer systems if they could potentially solve these issues. But this approach can be fundamentally flawed.

There is no “silver bullet” to correct for poor data, no all-encompassing ERP software that can fix all problems. If the data is not recorded accurately at ground level, then no system is going to be able to make sense of it. Also, if a well-established and fully functional ERP system is misconfigured, then using it may make things worse, not better.

The survey also found companies which tracked revenue and cost at the specific level of contracts were much more likely to report having accurate data (58%) as compared to those who recorded mixed data (38%). This once again reinforces the importance of getting into the “weeds” of data recording, rather than simply relying on a top-down software deployment to fix all of these problems.

The survey findings reinforce the idea that simply deploying an ERP to solve all problems does not work. There needs to be combination of software coupled with the ability to look at what data is collected at ground level, identify that single source of truth, and ensure it is entered and used properly. This pairs software expertise and consultancy, with a bespoke approach tailored to each company’s individual needs that helps build trust in the quality of data while allowing decision-makers to make plans with greater certainty.

Hitachi Vantara’s approach uses Oracle Cloud SaaS ERP as a foundation for a custom solution delivered to clients, configured specifically for each client to address

their unique challenges –and includes the suitable use of Enterprise Performance Management modules and application of its Data Modernization principles to what is recorded in and reported from their ERP system.

Owen Dowden explained: “Like any ERP it’s really about how it’s applied which is what

often makes the difference. The root cause is that you’re not often setting up your core

system in the way to get your information efficiently. We can configure the Oracle ERP

platform in a certain way and configure it to address those problems. By providing a better structure within ERP, we allow clients to centralize accurate reporting onto their Oracle ERP platform and save hundreds of thousands of dollars on third-party reporting tools.”

Ensuring data is accurate at every level, making sure there is one source of truth, and

implementing the best ERP for each individual company is the best way to ensure accuracy, reliability, and usability of financial data.

Accurate financial data maximizes efficiency and protects revenue in an increasingly uncertain world. It also supports longer term planning and enables companies to fulfil statutory obligations.

Companies have placed their trust in ERP software to help shoulder some of the burden, but it cannot do everything.

ERP-in-a-box causes problems due to the gaps it leaves because it is a “one size fits all” solution. But all companies are different. Not just in scale and the industries within which they operate, but in what data they record at ground level and what data is defined as the single source of truth.

This research uncovered an understanding of the problems caused by inaccurate financial reporting as well as a desire to migrate to newer systems if they could potentially solve these issues. But this approach can be fundamentally flawed.

There is no “silver bullet” to correct for poor data, no all-encompassing ERP software that can fix all problems. If the data is not recorded accurately at ground level, then no system is going to be able to make sense of it. Also, if a well-established and fully functional ERP system is misconfigured, then using it may make things worse, not better.

The survey also found companies which tracked revenue and cost at the specific level of contracts were much more likely to report having accurate data (58%) as compared to those who recorded mixed data (38%). This once again reinforces the importance of getting into the “weeds” of data recording, rather than simply relying on a top-down software deployment to fix all of these problems.

By subscribing to Hitachi Digital Services’ Insights and providing your e-mail, you agree and consent to Hitachi Digital Services´ Privacy Policy and Website Terms of Use. Data Controller: Hitachi Digital Services Corporation. Purpose: manage Hitachi Digital Services.

Read More +