Business resilience has been top priority for enterprises as they aim to revive and grow their businesses in a post-pandemic era. Digitization of their existing supply chain is the first step in achieving this goal, and Internet of Things (IoT) technology lies at the center of this. Around 40% firms have already embarked on this journey, leveraging IoT to develop an interconnected supply chain that brings together suppliers/vendors, logistics providers, manufacturers, wholesalers/retailers, and customersdispersed by geography. This is aiding firms in better demand forecasting, tracking and tracking of products and fleet, and better monitoring of asset conditions. As enterprises aim to accelerate the time-to-market of their supply chain initiatives, leverage of IoT-based solutions becomes pertinent for them. In this regard, they are partnering with IoT solution and service providers.

In this research, we present an assessment of solution as well as service providers that exhibit a strong focus on supply chain through their IoT-based solutions. This includes only providers that have developed IoT-enabled solutions aimed at addressing challenges across the supply chain landscape with use cases including, but not limited to, fleet management, inventory management, warehouse management, and cold chain monitoring.

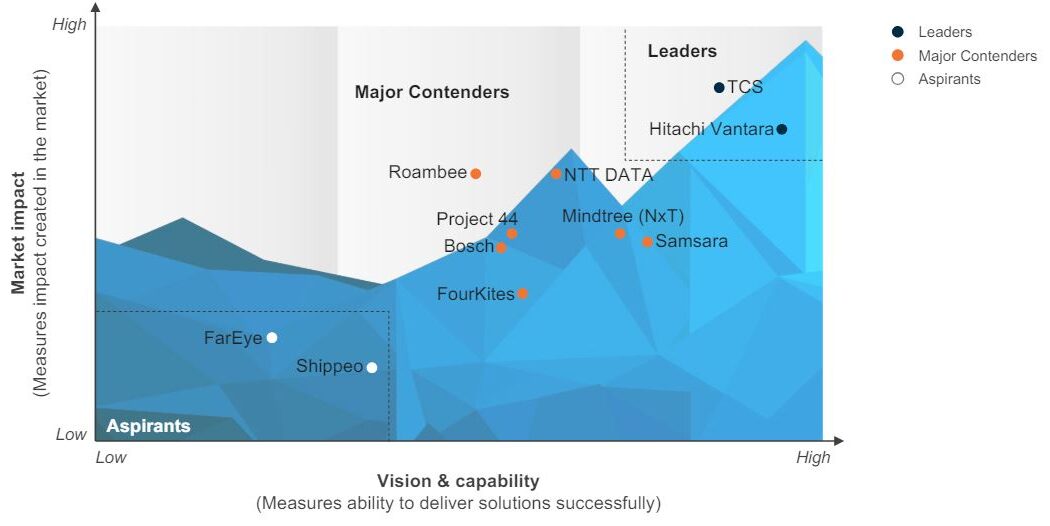

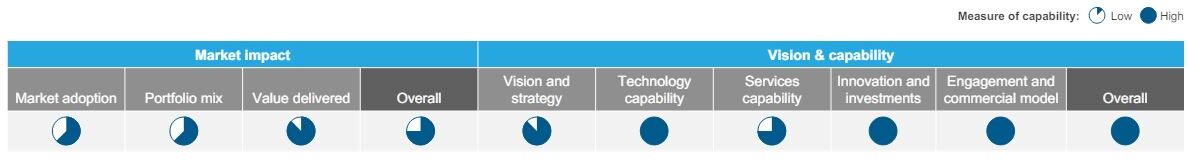

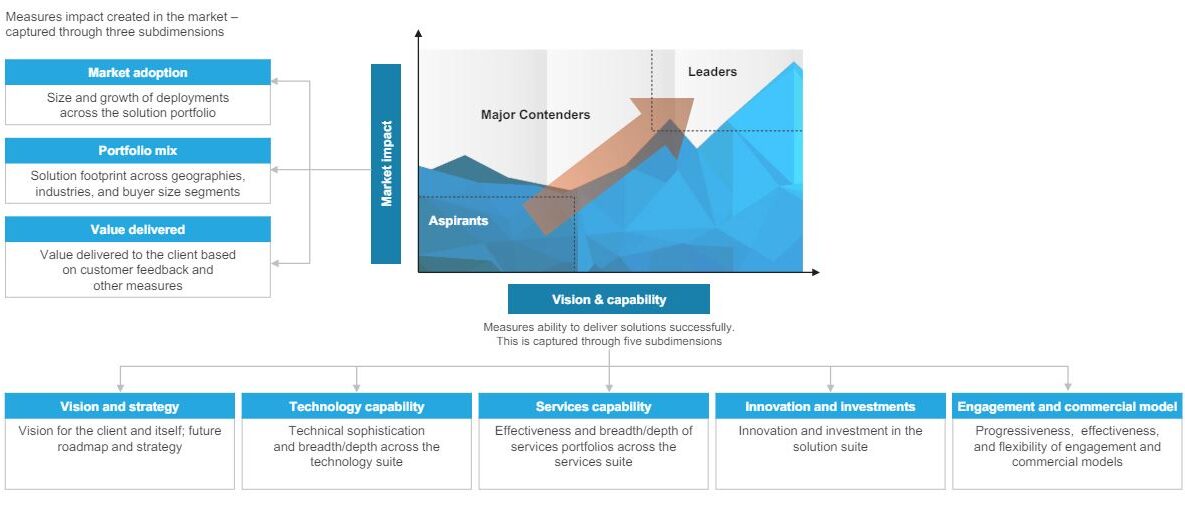

The assessment of these providers is featured on the IoT supply chain solutions PEAK Matrix®. Each solution provider profile provides insights into their strengths and limitations across themes including, but not limited to, services, investments, and case studies. The assessment is based on Everest Group’s annualRFI process for calendar year 2021, interactions with leading IoT supply chain solution providers, client reference checks, and an ongoing analysis of the IoT solutions market.

Global

11

IoT supply chain solutions

Hitachi Digital Services and TCS

Bosch, FourKites, Mindtree (NxT), NTT DATA, Project 44, Roambee, and Samsara

FarEye and Shippeo

Everest Group Internet of Things (IoT) Supply Chain Solutions PEAK Matrix® Assessment 20221

1. Assessments for FarEye, FourKites, Project 44, Samsara, and Shippeo exclude vendor inputs on this particular study and are based on Everest Group’s estimates and solution provider public disclosures. Source: Everest Group (2022)

Company mission/vision statement for IoT-enabled supply chain solutions

Hitachi Digital Services aims to position its Lumada suite of solutions as the platform of choice for all assetintensive and mission-critical industries. The firm aimed to leverage this solution to aid customers in bridging the domains of IT,OT, and business operations while offering a flexible approach to support on-premises, edge, hybrid, or cloud deployments.

Revenue from IoT supply chain solutions (excluding services)

| < US$10 million | US$10-50 million | US$50-100 million | > US$100 million |

|---|

IoT solution for tracking and monitoring mining equipment

Client: First Quantum Minerals

Business challenge

First Quantum Minerals was facing challenges in tracking and monitoring its mining equipment, like such as excavators, and was looking to leverage IoTsolutions that could aid them in this.

Solution

As part of this engagement, Hitachi provided First Quantum Minerals with fleet management, dispatch automation, and predictive maintenance capabilities on the cloud as well as edge. IoT-based connected assets included excavators, RDTs, and auxiliary equipment. The solution also provided asset health monitoring and, in conjunction with third-party partners, predictive analytics, and multi-layered AI with digital twinning aimed at reducing the total cost of maintenance.

Impact

The fleet management solution helped in monitoring the behavior of over 80 equipment units in operation.

IoT solution for asset management and predictive maintenance

Client: Deutsche Bahn

Business challenge

Deutsche Bahn, a German railway company was facing challenges in reducing the frequency of the train wheelset replacements.

Solution

A Machine Learning (ML) algorithm developed using historical data from parameters database aided in computing the frequency of wheelset parameter change. The firm implemented distancebased forecasting, allowing operators to assess risk based on actual utilization.

Impact

This led to cost-optimal scheduling and scoping of wheelset maintenance for the entire fleet along with early detection of critical conditions to avoid service interruptions or regulatory penalties from safety violations.

| Proprietary solutions (representative list) | ||

|---|---|---|

| Solution name | Details | |

| Hitachi Digital Services Asset Performance Management | A SaaS solution that runs on the Hitachi Digital Services IIoTplatform & aids in asset management & inventory management for supply chain initiatives. | |

| Hitachi Digital Services Manufacturing Insights (MFI) | It is a suite of individual & integrable solutions that runs on the IIoTplatform and aids in optimizing production operations with special focus on machines, quality, and process using the firm’s 4M (Man, Machine, Material, and Methods) approach. | |

| Hitachi Digital Services Enterprise Asset Management (EAM) | It provides recommendations across asset management and maintenance, scheduling and execution, work planning, supply chain and material management, multi-entity financial management, and people management. | |

| Hitachi Digital Services Edge Intelligence | Hitachi Digital Services Edge Intelligence provides actionable real-time insights at remote locations and enterprise-class data management, from edge-to-multicloud. | |

| Hitachi Digital Services DataOps | It aims to operationalizes data management with automation and collaboration and aid enterprises in building their own DataOps practice | |

| Partnerships (representative list) | ||

|---|---|---|

| Partner | Details | |

| Amazon Web Services (AWS) | Partnership aimed at offering Hitachi Digital Services industrial solutions on the AWS cloud platform and co-innovate to develop new IoT applications | |

| Microsoft | Partnership with Microsoft for offering Hitachi Digital Services Manufacturing Insights on the Microsoft Azure marketplace | |

| Ericsson, Cisco, and Verizon | Partnership with leading telecom providers to drive quicker access to data for real-time action | |

| Other investments (representative list) | ||

|---|---|---|

| Investment name | Details | |

| Patents | Developed IP in the areas of prognostics & stochastic modeling for asset performance maintenance & repair recommendations, including calculating remaining useful life | |

| R&D | Established CoEs, R&D centers, and research labs globally –with software development in Vancouver, Brisbane, Krakow, Kuala Lumpur, Detroit, Santa Clara, and more apart from Lumada Innovation Centers in Tokyo and Bangkok; Aim to invest USD 10 billion In R&D for sustainability related digital innovation in the next 3 years | |

| Acquisitions | In 2021, acquired Io-Tahoe, a subsidiary of the UK energy company Centrica, to bring together data engineering, science and analytics on an open, unified platform | |

Everest Group PEAK Matrix

Does the PEAK MatrixR assessment incorporate any subjective criteria?

Everest Group’s PEAK Matrix assessment adopts an unbiased and fact-based approach (leveraging provider / technology vendor RFIs and Everest Group’s proprietary databases containing providers’ deals and operational capability information). In addition, these results are validated/fine-tuned based on our market experience, buyer interaction, and provider/vendor briefings

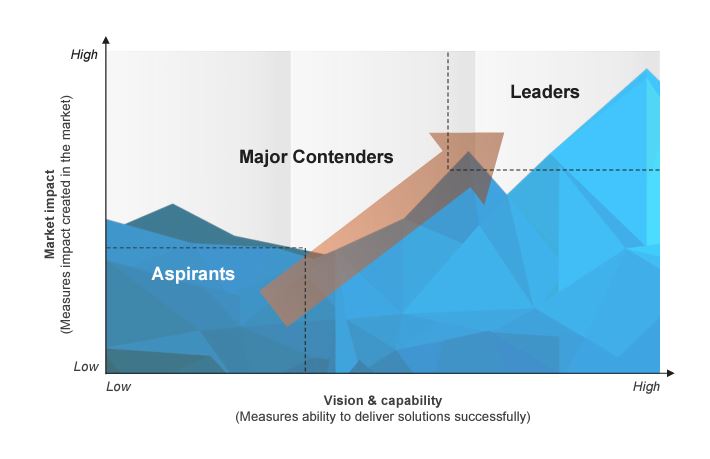

Is being a “Major Contender” or “Aspirant” on the PEAK Matrix, an unfavorable outcome?

No. The PEAK Matrix highlights and positions only the best-in-class providers/technology vendors in a particular space. There are a number of providers from the broader universe that are assessed and do not make it to the PEAK Matrix at all. Therefore, being represented on the PEAK Matrix is itself a favorable recognition

What other aspects of PEAK Matrix assessment are relevant to buyers and providers besides the “PEAK Matrix position”?

A PEAK Matrix position is only one aspect of Everest Group’s overall assessment. In addition to assigning a “Leader”, “Major Contender,” or “Aspirant” title, Everest Group highlights the distinctive capabilities and unique attributes of all the PEAK Matrix providers assessed in its report. The detailed metric-level assessment and associated commentary is helpful for buyers in selecting particular providers/vendors for their specific requirements. It also helps providers/vendors showcase their strengths in specific areas

What are the incentives for buyers and providers to participate/provide input to PEAK Matrix research?

By subscribing to Hitachi Digital Services’ Insights and providing your e-mail, you agree and consent to Hitachi Digital Services´ Privacy Policy and Website Terms of Use. Data Controller: Hitachi Digital Services Corporation. Purpose: manage Hitachi Digital Services.

Read More +