Table of Contents

- Executive Summary

- Challenges Faced by Financial Service Companies

- How Hitachi Vantara Can Help

- It’s an Ecosystem Play

- Customer Success in the Regulatory and Compliance Space

- Conclusion : Capitalizing on Risk Opportunity

Executive Summary

Financial institutions know all too well that risk in business is inevitable. Savvy financial institutions use the need to manage risk as an opportunity not only to gain the trust of their customers but to showcase their operational excellence and mature business approach. The fast-growing RegTech industry is spurring an evolution in how financial service companies do business.

Challenges Faced by Financial Service Companies

With a post-pandemic recession looming and tightening compliance policies by global regulators, banks and financial institutions are facing very challenging scenarios. Regulators are now shifting focus to specific geographic needs, concerns and requirements.

Financial services organizations understand the implications of these regulations on their business, leading them to identify strategic technology vendors who can leverage their expertise to help them comply with these evolving regulations.

Whether it’s the BASEL framework (a response to the 2008 economic crisis), which improves banks’ risk management through minimum capital requirement, or GDPR/CCPA for personal data protection, regulators are making the boundaries more stringent than ever for financial services providers. Many are looking at strategic partners who can help them comply with regulations by protecting the data, which is at the heart of various regulatory frameworks

Common challenges we hear from customers include regulatory data management, compliance process optimization and sustainability risk management.

Challenges we hear from customers related to regulatory data management

- Reliably store data and maintain compliance with regulatory requirements for data retention.

- Big data privacy exposure with potential regulatory fines and a tarnished brand.

- data types, including market and trade data.

- Extracting greater value from complex and unstructured market data.

- Monitoring enterprise data management and trading activities.

- Personally identifiable information (PII) data protection.

- Data retention, indexing and accessibility for companies that trade or broker financial securities such as stocks, bonds and futures.

Challenges we hear from customers related to regulatory compliance process optimization

- Global compliance management,

- including BCBS239, BASEL III LCR, BASEL IV, EPS and MIFID II.

- Financial risk management, including liquidity, solvency, credit and market risks.

- Digitizing and automating market regulation, structure and transparency functions.

- Modernizing reporting systems for regulatory compliance management.

- Fraud check automation and efficient fraud detection.

- Efficient Know Your Customer (KYC) processes, including extracting and verifying customer/investor information from documents related to finance and investment.

- Improving time-to-market for business operations.

Challenges we hear from customers related to sustainability risk management

- Accurately calculating physical and climate risk.

- Carbon accounting, offsetting and decarbonization of data centers.

- Sustainability finance, including green finance transparency issues.

- Smart and green building initiatives that fail to meet KPIs envisioned at the planning stage.

- Power assessment and efficiency transformations issues.

- Tracking and reporting environmental, social and governance (ESG) data.

How Hitachi Vantara Can Help

Hitachi provides end-to-end risk and compliance services for banking and financial service companies, including:

- Consulting & Advisory Services, including GRC, risk assessment, risk architecture, modeling and regulatory RTS.

- Development, Implementation & Support for risk and compliance platforms.

- Regulatory Data Management & Reporting leveraging our frameworks, IPs, Solutions and accelerators.

- Regulatory Operations & Compliance Management in accordance with customer-specific requirements.

Hitachi Vantara provides a wide range of risk, regulatory and compliance services ranging from near real-time market risk analytics and complex regulatory reporting solutions to petabyte-scale communications logging and monitoring solutions

This service offering includes a full consultation with our customers to implement programs with GRC objectives using our proprietary E3 Framework approach.

Hitachi Vantara’s E3 Framework

Regulatory Data Management Services

Hitachi’s regulatory data management framework goes from extracting source data from relevant risk, finance and trading data sources to building regulatory transformation rules and data warehouses and lakes for regulatory reports and data feeds.

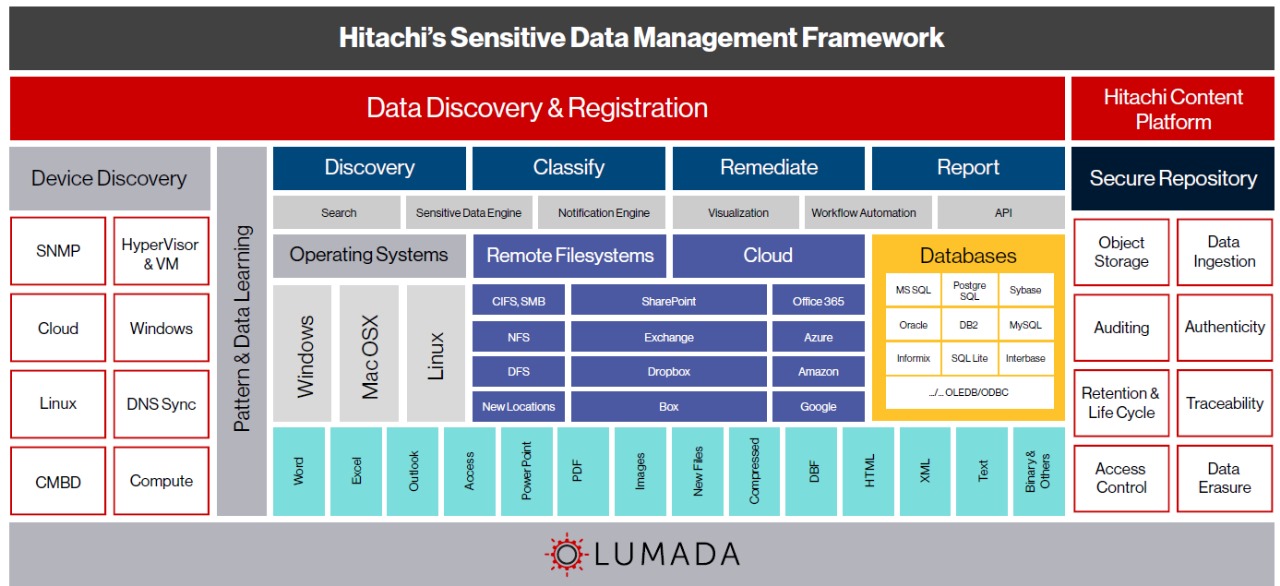

A Framework for Sensitive Data Management

Hitachi Vantara helps organizations address sensitive data challenges to fuel data-driven innovation and reduce risk and costs through our proprietary Lumada and Pentaho platforms and specific capabilities, including:

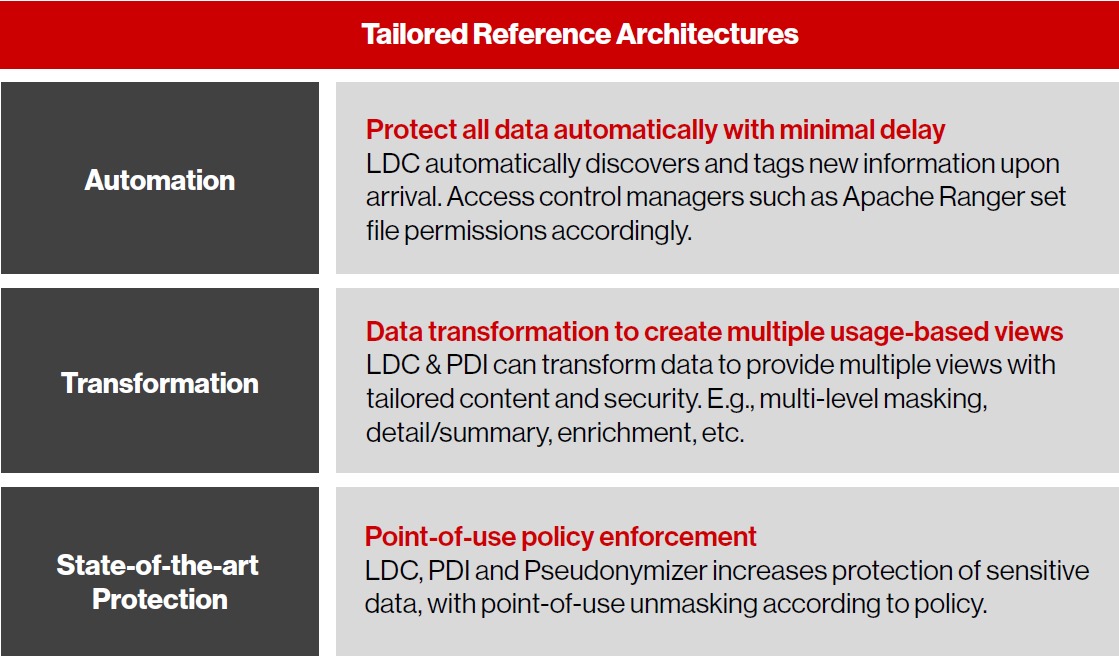

- Lumada Data Catalog (LDC) – An AI-driven data catalog that accelerates data discovery for analytics while ensuring compliance. LDC automatically discovers and tags new information upon arrival. Access control managers such as Apache Ranger set file permissions accordingly.

- Pentaho Data Integration (PDI) – A modern data integration and orchestration platform to access, prepare and blend data from any source. PDI and LDC can transform data to provide multiple views with tailored content and security, e.g., multi-level masking, detail/summary and enrichment.

Hitachi’s sensitive data management framework leverages proprietary products and tools.

Along with tools such as Pseudonymizer, LDC and PDI increase the protection of sensitive data, with point-of-use unmasking according to policy. Hitachi also has tailored reference architectures, as illustrated below for sensitive data management.

These solutions provide benefits and functionality, including:

- Automated identification and enforcement of sensitive data at a massive scale.

- Identification of a wide variety of sensitive data and enrichment with businessspecific context.

- AI-driven tagging for high accuracy and trust with crowdsourcing and community ratings.

Hitachi Vantara uses a tailored reference architecture approach to sensitive data managemet

Managing Sustainability Risk and Compliance

Hitachi Vantara is a global pioneer in sustainability, aiming to be net zero by 2030 and have a carbon-neutral value chain by 2050. Hitachi has proactively contributed to global ESG initiatives and standards such as TCFD, GRI and UNO and was a Principal Partner of COP26. Leveraging the significant expertise and experience of the wider Hitachi Group, we bring together expertise across various industries to support the needs of our customers in the financial services space. Depending on their size, these are generally focused on:

Large financial services customers

- Assessment and planning for ESG investments.

- Tracking investments for identified ESG projects.

- ESG data tracking and reporting.

Mid-market and small financial services customers

- Shared data centers and data center decarbonization.

- Acceleration to cloud.

- ESG data tracking and reporting.

In addition to our solutions, we have also been investing and/or co-creating innovative sustainability risk and compliance solutions to help our financial services clients. These include:

Data Center Decarbonization Framework

A multi-pronged strategy for decarbonized enterprise data centers. Key components include sustainable storage infrastructure, a carbon insights platform and optimized power solution (microgrids, HVAC, low voltage DC, etc.), a liquid cooling platform and an application efficiency framework following Green Software Foundation principles.