Financial institutions know all too well that risk in business is inevitable. Savvy financial institutions use the need to manage risk as an opportunity not only to gain the trust of their customers but to showcase their operational excellence and mature business approach. The fast-growing RegTech industry is spurring an evolution in how financial service companies do business.

RegTech is top of mind for financial institutions to comply with Sarbanes-Oxley, Basel II, Solvency II and Dodd-Frank, as well as guarding against data and security breaches. On average, tier-1 banks spend over $1B annually to safeguard themselves against compliance mandates

A trusted IT services partner can make all the difference for companies managing risk scenarios such as incident management, IT risk, operational risk, cyber risk, disaster recovery, sustainability risk and vendor/third-party risk.

Head of Banking & Financial Services Hitachi Digital Services

Service providers can help these customers implement their governance, risk and compliance (GRC) program, gain a competitive advantage and reduce costs.

Financial service institutions also need a trusted partner to help invest in new technologies while maintaining hyper-customer centricity. The right IT service partner can guide financial service companies to ensure innovation delivers what it promises.

With a post-pandemic recession looming and tightening compliance policies by global regulators, banks and financial institutions are facing very challenging scenarios. Regulators are now shifting focus to specific geographic needs, concerns and requirements. Financial services organizations understand the implications of these regulations on their business, leading them to identify strategic technology vendors who can leverage their expertise to help them comply with these evolving regulations.

Whether it’s the BASEL framework (a response to the 2008 economic crisis), which improves banks’ risk management through minimum capital requirement, or GDPR/CCPA for personal data protection, regulators are making the boundaries more stringent than ever for financial services providers. Many are looking at strategic partners who can help them comply with regulations by protecting the data, which is at the heart of various regulatory frameworks.

Common challenges we hear from customers include regulatory data management, compliance process optimization and sustainability risk management.

Hitachi provides end-to-end risk and compliance services for banking and financial service companies, including:

Hitachi Digital Services provides a wide range of risk, regulatory and compliance services ranging from near real-time market risk analytics and complex regulatory reporting solutions to petabyte-scale communications logging and monitoring solutions

This service offering includes a full consultation with our customers to implement programs with GRC objectives using our proprietary E3 Framework approach.

Invest time in value-based risk assessment and mapping the company’s portfolios to their GRC program objectives. We also help them achieve their desired critical outcomes by building and modeling a comprehensive risk architecture to reach the finalized key objectives, documenting critical operational risks and creating a blueprint plan for execution.

Work with customers to execute their GRC program, keeping in view their own target timeline. This includes evaluating the right platform for their unique GRC requirements.

Applying our knowledge of execution capabilities, speed and current maturity of the company’s GRC program, this iterative phase helps scale execution at the requisite pace. We continue to measure and improve overall efficiency and accelerate the program journey as we execute.

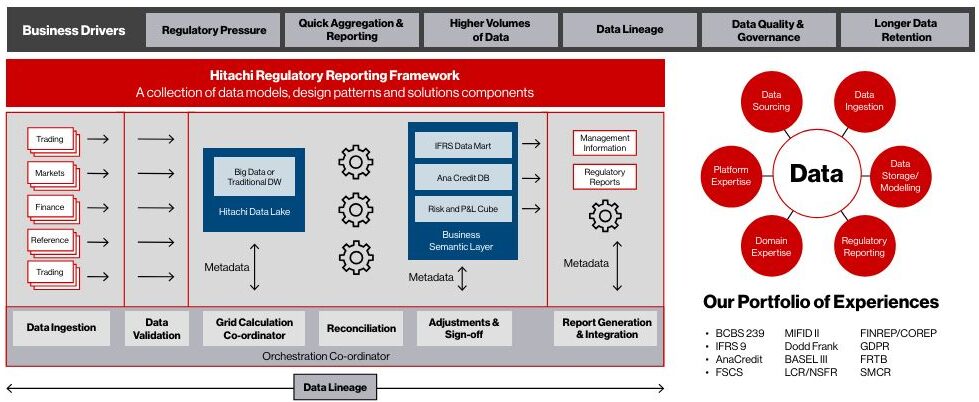

Hitachi’s regulatory data management framework goes from extracting source data from relevant risk, finance and trading data sources to building regulatory transformation rules and data warehouses and lakes for regulatory reports and data feeds.

These solutions provide benefits and functionality, including:

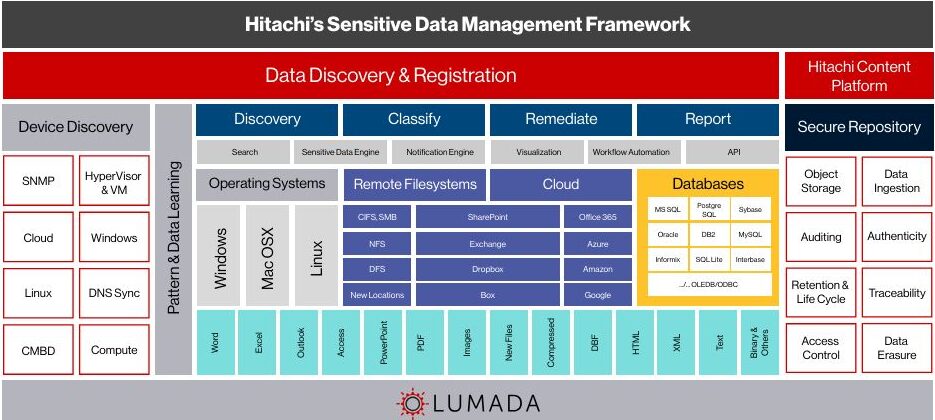

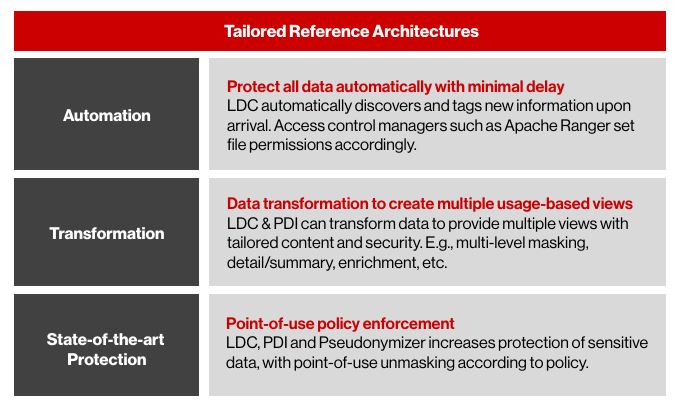

Hitachi Digital Services uses a tailored reference architecture approach to sensitive data managemet.

Hitachi Digital Services is a global pioneer in sustainability, aiming to be net zero by 2030 and have a carbon-neutral value chain by 2050. Hitachi has proactively contributed to global ESG initiatives and standards such as TCFD, GRI and UNO and was a Principal Partner of COP26. Leveraging the significant expertise and experience of the wider Hitachi Group, we bring together expertise across various industries to support the needs of our customers in the financial services space. Depending on their size, these are generally focused on:

A multi-pronged strategy for decarbonized enterprise data centers. Key components include sustainable storage infrastructure, a carbon insights platform and optimized power solution (microgrids, HVAC, low voltage DC, etc.), a liquid cooling platform and an application efficiency framework following Green Software Foundation principles.

Provided by the Hitachi Energy, the exercise initially focuses on commercial efficiency and then extends to ensure maximum sustainability

Automates elements of managing regulatory reporting, such as SFDR (sustainability finance disclosure reporting) and SDR (sustainability disclosure reporting).

Hitachi’s regulatory reporting framework extracts data from relevant risk, finance and trading sources to build regulatory transformation rules, and data warehouses and data lakes for regulatory reports and data feeds.

Computes the climate risk for properties on a customer’s mortgage book and aggregates the overall climate risk for the portfolio.

Trusted mechanism to provide full traceability of sustainable investments and their utilization on relevant projects, using appropriate sensors and data capture methods. A leading Japanese financial instruments exchange holding organization has piloted the platform.

Hitachi focuses on solving problems that are naturally closest to the realm of ESG. These are often issues that we face within Hitachi Group companies and solutions that utilize technologies where Hitachi has a long-standing presence across IT and OT, such as blockchain, IoT and AI.

As interest in ESG grows, the market has also increased significantly, including several green bonds, or bonds explicitly allocated for use related to the environment. According to Gartner, green and sustainable finance will become mainstream in two-to-five years. Hitachi is well positioned to help our customers engage in this process, including:

As more banks move to the cloud, regulations such as the Digital Operations Resiliency Act (DORA) will also gain prominence. DORA is designed to improve the cybersecurity and operational resiliency of the financial services sector. With Hitachi’s expertise and presence spanning both on-prem and hybrid cloud environments, we are uniquely positioned to guide customers in this space.

In addition, the complexity of modern cloud workloads requires financial service providers to implement an equally modern operating model for managing cloud application reliability, security, compliance and cost. Hitachi Application Reliability Centers (HARC) bring together best-in-class frameworks, technologies, automated tools and people to design, build and run their most demanding applications. This includes delivering Site Reliability-as-a-Service and 24/7 cloud management, creating a First Time Right (FTR) application ecosystem with a deep defense mechanism across different layers at the cloud, cluster, container and code levels. Hitachi is deeply invested in supporting financial service customers from our two HARC operational centers in Dallas, TX and Hyderabad, India.

With evolving technology ecosystems and emerging risk areas, no organization can solve the varied risk scenarios alone. With our broad partner ecosystem, Hitachi can leverage the expertise and experience of leading third-party providers such as Moody’s Analytics, Audax labs, Collibra, Ortecha and Spirion.

We are also investing in forging strong partnerships with leading platforms/products. And augmenting our capability via acquisitions, including Waterline Data and Io-Tahoe, now part of our Lumada portfolio of data management, data cataloging, DataOps, and data quality and governance solutions.

We also strengthened our third-party partnerships and built a risk and compliance solution ecosystem. This includes forging relationships with industry leaders such as Metricstream, RSA Archer, Nice Actimize, Fusion Risk Management, Moody’s, Murex, Ortecha, Charles River, Audax, OpenStack, Snowflake and Solidatus.

Finally, we are actively identifying and finalizing partnerships with fintech and RegTech upstarts in key risk and compliance practice focus areas. We expect a significant increase in product implementation engagements and sell-to and sellwith activities with third-party providers.

Hitachi provided a real-time data lake-based analytic platform with NLP for data extraction with a centralized repository for structured and unstructured files. We employed unsupervised techniques and machine learning algorithms to evaluate time series data leveraging cloud-based AI and ML tools. Thousands of financial disclosure documents were used to train the solution to identify key data accurately. As a result, the customer developed an advanced search algorithm enabling users to find relevant information more quickly and efficiently using natural language processing. The customer was able to digitize and automate market regulation, structure and transparency functions and improve time-to-market for its core business operations.

Working collaboratively with Microsoft, we delivered a cuttingedge analytics solution that identified anomalies in market data and correlated them to news-based market events using NLP. Using our natural language processing model to classify ServiceNow tickets, the solution allowed the bank to alleviate a costly, time-consuming manual process. The bank can now visualize and monitor market data and trading anomalies based on the correlation of market data changes and news sentiment.

To improve the efficiency of fraud detection during document processing, we use our Hitachi IP Dark Data Solution to fasttrack transformation and streamline the previous manual process. The solution enabled flexible data extraction from unstructured documents, complementing other document ingestion solutions focused on structured or semi-structured documents. The ML technology is based on a system for quickly training data with limited supervision.

Based on its success, the customer is now exploring the solution for scenarios such as KYC/fraud detection, loan audit, trade finance and AML.

Hitachi has built several regulatory reporting platforms for a European bank, including their liquidity, market and credit risk platforms. This includes performing data analysis, sourcing data, building extraction routines, built-in necessary regulatory rules, building the underlying data store (data warehouse/data lake) and the appropriate reporting/data export mechanisms. We also built data extraction and metadata tagging routines to incorporate into our proprietary Hitachi Content Platform (HCP). As well as configured Hitachi Content Intelligence (HCI) solution for regulatory data retrieval. The platform enabled the bank to achieve compliance with BCBS239, BASEL III LCR, EPS Liquidity Regulation in the U.S. and is currently delivering BASEL IV for the credit stream. The solution also enables the bank to monitor trading activities using the electronics communications monitoring (ECM) platform and comply with regulations such as MIFID II.

Hitachi is helping a leading British bank achieve its carbon-neutral goal by incorporating ESG factors in its retail and commercial businesses. This includes enabling a transparent project creation where borrowers create individual or aggregated project profiles that become visible to lenders. The project details can be based on planned specific projects, data analytics of operations or systemic change advisory services. The solution further helps find and match intermediate lending between borrowers (using environmentally sustainable technologies) and lenders, providing better terms based on transparent and verifiable reporting. The projects include services such as systemic change advisory, data analysis, auditing and verification. Once the project generates operational data, it is monitored using IoT devices, then communicated to the platform to be stored and converted into KPIs using blockchain.

The GRC space will evolve and become more complex as more financial service providers move to the cloud and go beyond the consumption of simple cloud-based infrastructure as a service offering from public cloud vendors. The applications they run on these platforms and the enormous volume of accompanying data make them increasingly prone to cyber threats. This demands protection through a defense in depth mechanism and zero trust approach.

To succeed, businesses must design applications with reliability and resiliency built into their core design. Data will be at the heart of all associated regulatory requirements. Protecting it and remaining compliant with industry-specific regulations requires a multi-disciplinary approach that cuts across people, processes, and technology. The skills needed for these end-to-end compliance objectives demand domain expertise regarding data management, governance and archival capabilities to protect it from growing threats.

Hitachi Digital Services broad range of risk and compliance services makes us an ideal partner for businesses looking to create a competitive advantage in the global financial services space. We work with 44 of the 50 leading global banks and financial service providers to help them achieve and maintain regulatory governance and compliance. We also provide full-stack engineering, managed service and advisory capabilities and serve as a global digital modernization partner to financial institutions.

At Hitachi, we also place a high degree of importance on regulatory compliance. Achieving sustainability and creating social impact have been our mission for a century. We have a target of being net zero by 2030, and we are a proactive contributor to global ESG standards and initiatives such as TCFD, GRI, and UNO as well as a partner to COP27.

On how we can help your financial service organization turn inherent risk into an opportunity to build trust and create competitive advantage.

By subscribing to Hitachi Digital Services’ Insights and providing your e-mail, you agree and consent to Hitachi Digital Services´ Privacy Policy and Website Terms of Use. Data Controller: Hitachi Digital Services Corporation. Purpose: manage Hitachi Digital Services.

Read More +